Where did the $12 trillion of covid spending go?

Part 8: Correlation, causation and money printing

This is part 8 of my series on the strange post covid market rally due to $12 trillion in new spending.

Part 1 was focused on purchases of mortgage backed securities by the Federal Reserve.

Part 2 was focused on increases in asset prices across all sectors and asset classes.

Part 3 was a satirical alternative explanation of what could be going on.

Part 4 was about the likelihood of future inflation and hedging strategies

Part 5 discussed the role USD has as a reserve currency

Part 6 discussed Warren Buffets assertion that low rates help tech stocks

Part 7 was focused on personal savings

If you’re interested in this series, subscribe below to receive updates. It’s free.

The latest inflation numbers have confirmed that we in fact have inflation and its likely non-transitory. Year over year inflation is 7.5%, a 40-year high. We saw across the board price increases in addition to supply shortages.

My first post in the series was in April 2021. I have since argued that the increase in money supply will lead to disastrous consequences which include market distortions and inflation.

The most obvious market distortion was the dramatic rise in asset prices to well past pre-covid levels. At the time I wrote my first post in the series, S&P500 was up 20% from its pre-covid high. Note that this was while businesses were shutdown indefinitely and most people were under some kind of quarantine. Since then, the market is up another 10%, because why not? Dramatic price increases hit pretty much every other asset class from real estate to commodities.

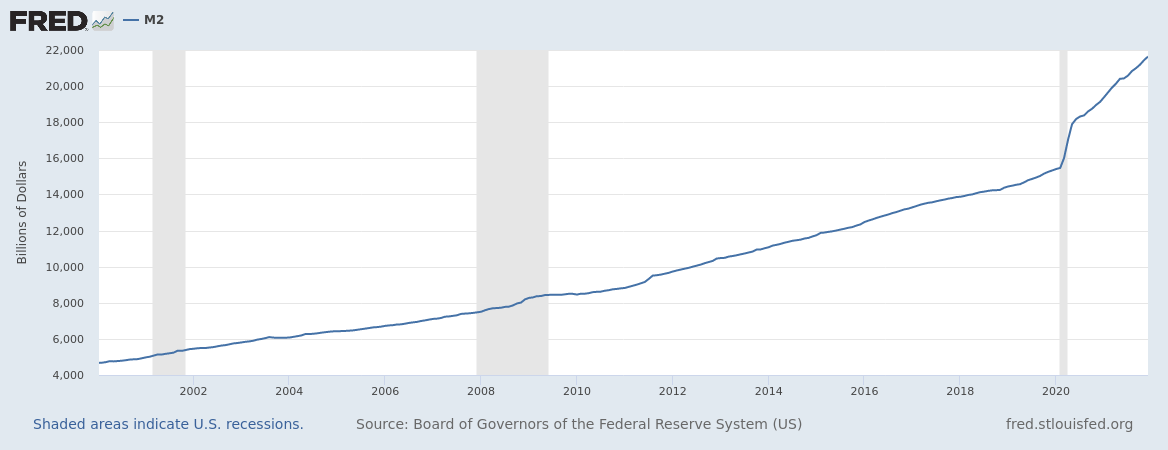

Now consumer prices are rising. I have long argued that the inflation we’re experiencing is due to the aggressive monetary policy that increased the M2 money supply by about 37% in about two years, a dramatic departure from our prior policy.

Correlation and Causation

I don’t think its a coincidence that inflation is coming off the heels of money printing, but I sometimes hear “correlation does not imply causation” as a way to brush off my concern.

This is a phrase that has permeated the collective conscious and in my opinion has stopped being useful. While it’s certainly true, you can re-frame the facts to give a clear picture.

Nearly every high inflationary event was preceded by the central bank printing or debasing money

The central bank printed a lot of money

We are experiencing inflation

This is not enough to prove a relationship, but its a start. You need a plausible explanation about the relationship. My explanation is simple: if you have more dollars chasing the same amount of goods, the price of the goods will go up.

On the extremes its obvious. In the Weimar Republic between 1921 to 1923, the central bank created money out of thin air to pay reparations to allies. This debased the value of the currency and led to hyperinflation.

Again, you don’t see inflation every time the central bank prints money, but if you do see inflation, it’s likely because you’re printing too much money. Similarly you don’t get drunk every time you drink alcohol, but if you’re starting to feel drunk, it’s probably because you drank too much alcohol.

Something Lenin, Keynes and Hayek can agree on

John Maynard Keynes is the economist that underpins most of modern economics. He was center-left and proposed an interventionist monetary and fiscal policy and was tolerant of mild to moderate inflation. But even he was not delusional about what causes inflation.

In Economic Consequences of the Peace, by Keynes, he wrote the following about inflation:

Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some.

…

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

But its really the fault of the greedy profiteers taking advantage of higher prices right? Animal spirits? No.

These "profiteers" are, broadly speaking, the entrepreneur class of capitalists, that is to say, the active and constructive element in the whole capitalist society, who in a period of rapidly rising prices cannot but get rich quick whether they wish it or desire it or not. If prices are continually rising, every trader who has purchased for stock or owns property and plant inevitably makes profits. By directing hatred against this class, therefore, the European governments are carrying a step further the fatal process which the subtle mind of Lenin had consciously conceived. The profiteers are a consequence and not a cause of rising prices. By combining a popular hatred of the class of entrepreneurs with the blow already given to social security by the violent and arbitrary disturbance of contract and of the established equilibrium of wealth which is the inevitable result of inflation, these governments are fast rendering impossible a continuance of the social and economic order of the 19th century. But they have no plan for replacing it....

Keynes also comments on historical examples of inflation in Europe and pins the blame on debasement:

The inflationism of the currency systems of Europe has proceeded to extraordinary lengths. The various belligerent governments, unable or too timid or too short-sighted to secure from loans or taxes the resources they required, have printed notes for the balance.

Only in 2022 can arm-chair Twitter economists be sitting there, stroking their chin and wondering what is driving prices up.

So we have something that precedes high inflation in nearly every historical example. We have a plausible explanation of why it should lead to inflation. We have broad consensus across the political spectrum on money debasement being the root cause of inflation. But, you know, “correlation doesn’t imply causation” so throw everything out the window.

Keynes was an awful man and his thoughts came from a very bad place. There is much better inspiration elsewhere.

https://mises.org/wire/keynes-eugenics-race-and-population-control