This is part 2 about where the $12 trillion the US government allocated for covid relief went. The first post discussed the money used to purchase mortgage backed securities. This post will discuss the impact on asset prices. If you’re interested in this series and want to receive future updates, subscribe below. Unless otherwise specified, all data was taken from Koyfin (unaffiliated - incredible free platform).

Take the 10 largest commodities and look at their price movements over the last 3 months, 6 months, 1 year and 3 years.

The 1 year return is tricky because we just happen to be about one year since three weeks to flatten the curve. So naturally there was a correction in the first quarter of last year where all markets fell. Take a look at corn, wheat and copper prices changes from 01-01-2020 to 04-01-2020:

Now take a look at those prices from 2020-01-01 up to today:

So we see a similar story of commodity price appreciation when looking at annual returns (2020 and year to date):

Crude oil is interesting because it was affected by a demand shock as people were traveling less. Now that demand is picking back up, the price is increasing as well.

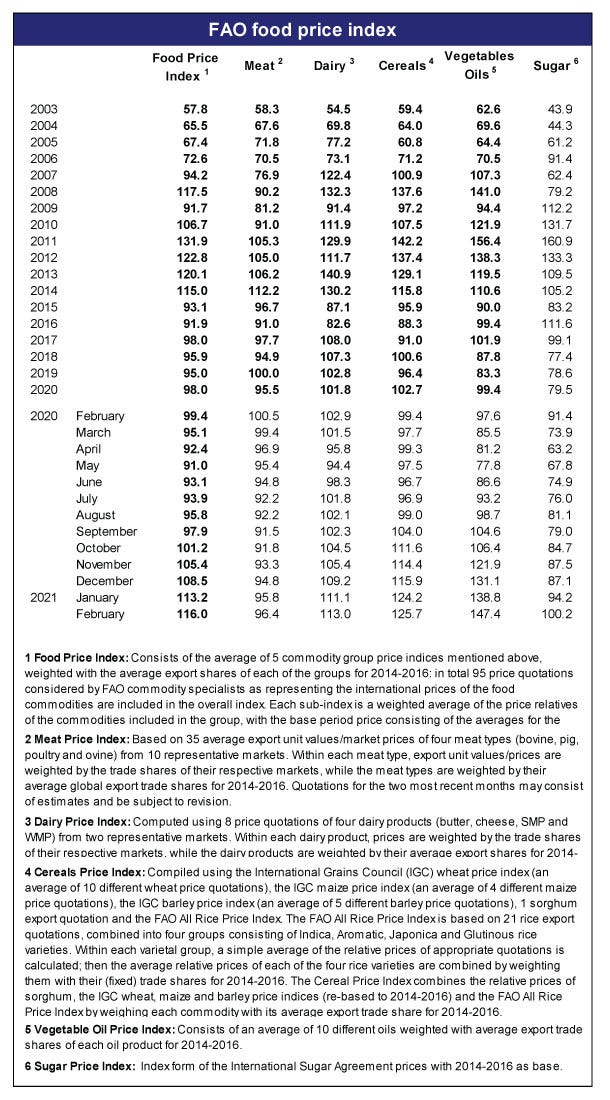

Food prices

Commodity prices are famously volatile, so they’re excluded from consumer price index calculations. We can also look at global food prices as reported by the Food and Agriculture Organization of the UN (FAO). FAO Food Price Index is a measure of the monthly change in international prices of a basket of food commodities. The index has gone up from a level of 95 in 2019 to 116 in February 2021.

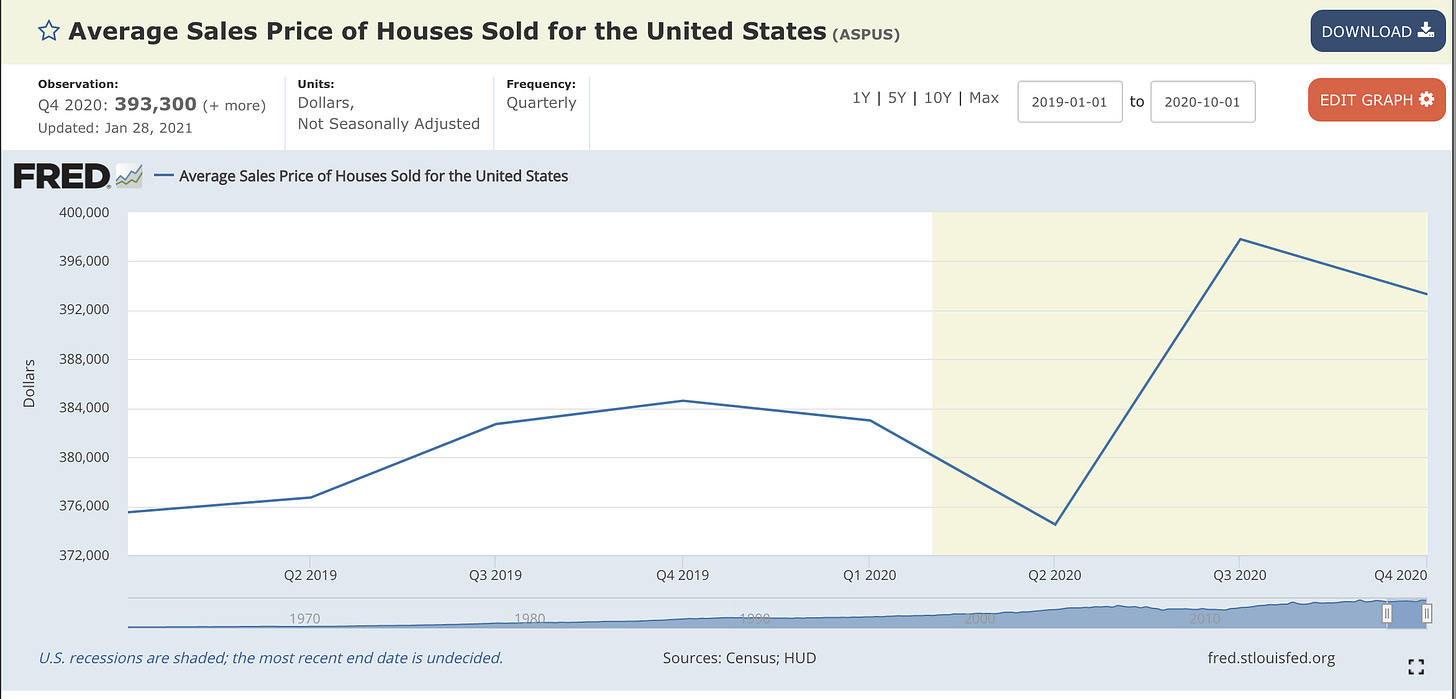

Home prices

Home sales prices also more than recovered, with just a small dip in Q2 2020

This continues an overall upward trend of home prices:

This is in no small part due to continued low interest rates. As discussed in a prior post, low interest rates have an inflationary effect on home valuations. For instance, if interest rates were 3% as opposed to 4%, a $1,000 monthly payment could support a mortgage of $237k, compared to $209k if rates were 4%.

But note that rates were originally slashed to 0 in response to the 2008 crisis, but prices didn’t recover immediately and remained at ~2005 levels until 2013. But that situation was a clear case of a real estate asset bubble, so that was more of a correction.

Equity prices

Equity prices have appreciated considerably pretty much across the board in the last year and even 3 years.

In the US, nearly all sectors have appreciated considerably in the last 3 years with technology and consumer discretionary leading the way.

Even JETS, the US airline ETF is on its way to recovering to pre-covid levels, despite continued reduced demand, increased costs and the post-covid reality that a global pandemic could stop travel indefinitely at any time. Bailouts probably helped as well.

Note that all these price changes are happening despite a global slowdown of demand and growth. Year over year GDP is down for most countries:

Energy prices are rising despite less travel. Home prices are rising despite the reduced demand for urban areas due to work from home. Food prices are rising despite higher unemployment.

The other point is that government yields are historically low or even negative across much of the world. What essentially happened was:

Trillions of dollars of paper money were simultaneously created by pretty much all Western countries around the globe (US was $36k for every man woman and child)

That money was distributed through buying government bonds/financial assets, transfers or services provided

Government yields were reduced so the money couldn’t appreciate just sitting there

All other financial assets were bid up significantly higher valuations than pre-crisis, despite worse prospects for growth

Final thoughts

I’m obviously concerned about the dramatic rise in asset prices. We don’t include asset prices in inflation numbers but if 2008 taught us anything, its that inflated asset prices can be disastrous. 2008 was an asset bubble that hurt the purchasing power of millions when the paper wealth people built up in their home vanished. Homeowners weren’t able to roll over their debt and refinance once the appreciation stopped. This led to a global recession that took years to recover from.

In the modern case of asset inflation, we could see higher prices in consumer goods through inflation. The other option is the continued growth in asset prices across the board. There was no political cost yet to the increasing monetary base, so I imagine money creation will continue. This will also increase wealth inequality since inflated asset prices disproportionately benefit the wealthy, which may lead to political unrest.

The only thing that is not an option is for things to go on like this indefinitely with the monetary base and debt growing 20%+ year after year.