Where did the $12 trillion of Covid spending go?

Part 6: Warren Buffett on the effect of low rates on the tech giants

This is part 6 of my series on the strange post covid market rally due to $12 trillion in new spending.

Part 1 was focused on purchases of mortgage backed securities by the Federal Reserve.

Part 2 was focused on increases in asset prices across all sectors and asset classes.

Part 3 was an alternative explanation of what could be going on.

Part 4 was about the likelihood of future inflation and hedging strategies

Part 5 discussed the role USD has as a reserve currency

Every chart, unless otherwise linked was made using koyfin (unaffiliated - incredible free Bloomberg-like terminal).

If you’re interested in this series, subscribe below to receive updates. It’s free.

Warren Buffett was recently asked about the stock price appreciation of large tech companies over the last few years.

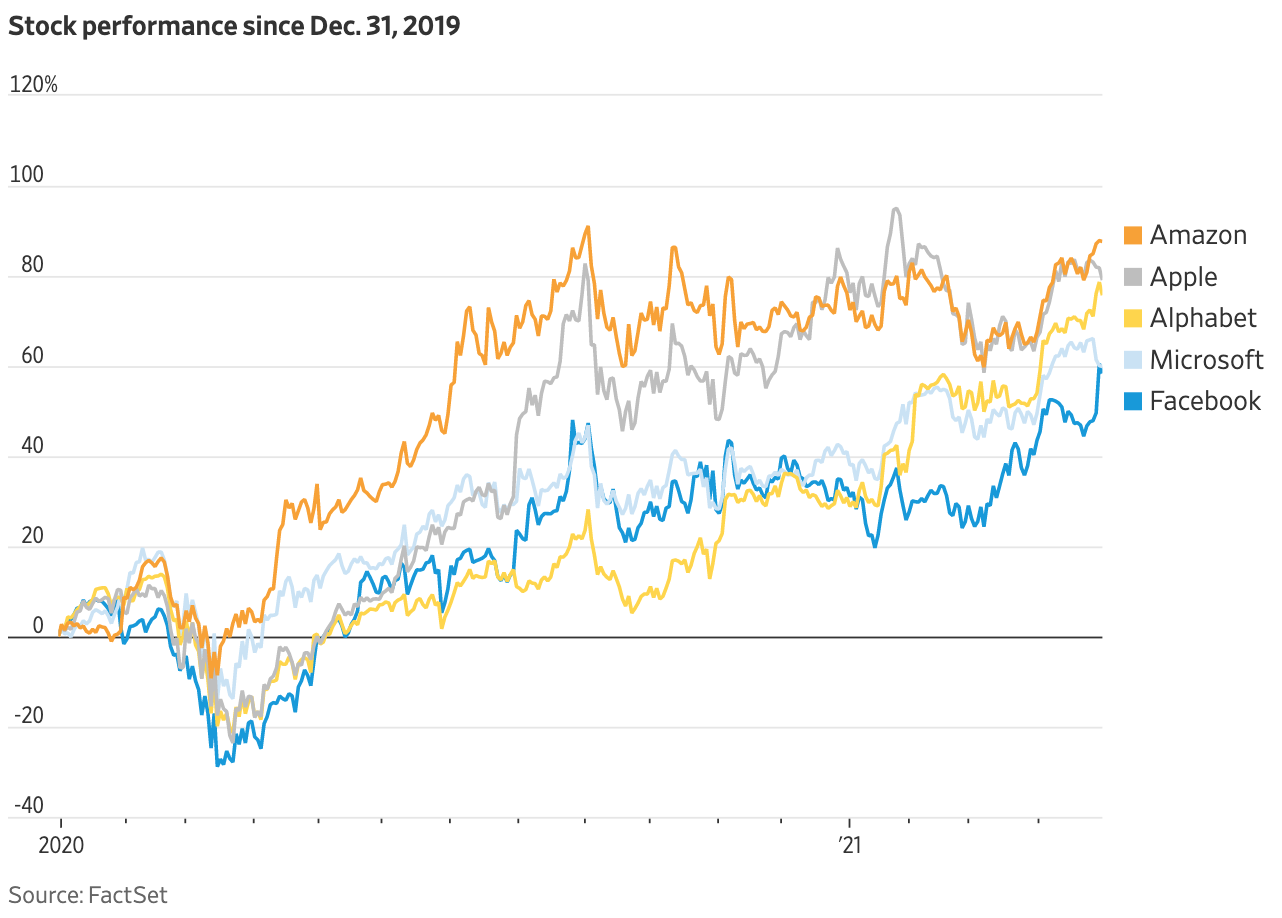

The five largest tech companies (Amazon, Apple, Alphabet, Microsoft and Facebook), have all appreciated at least 60% since the start of 2020. Note that this is relative to the pre-shutdown related slump in equity prices.

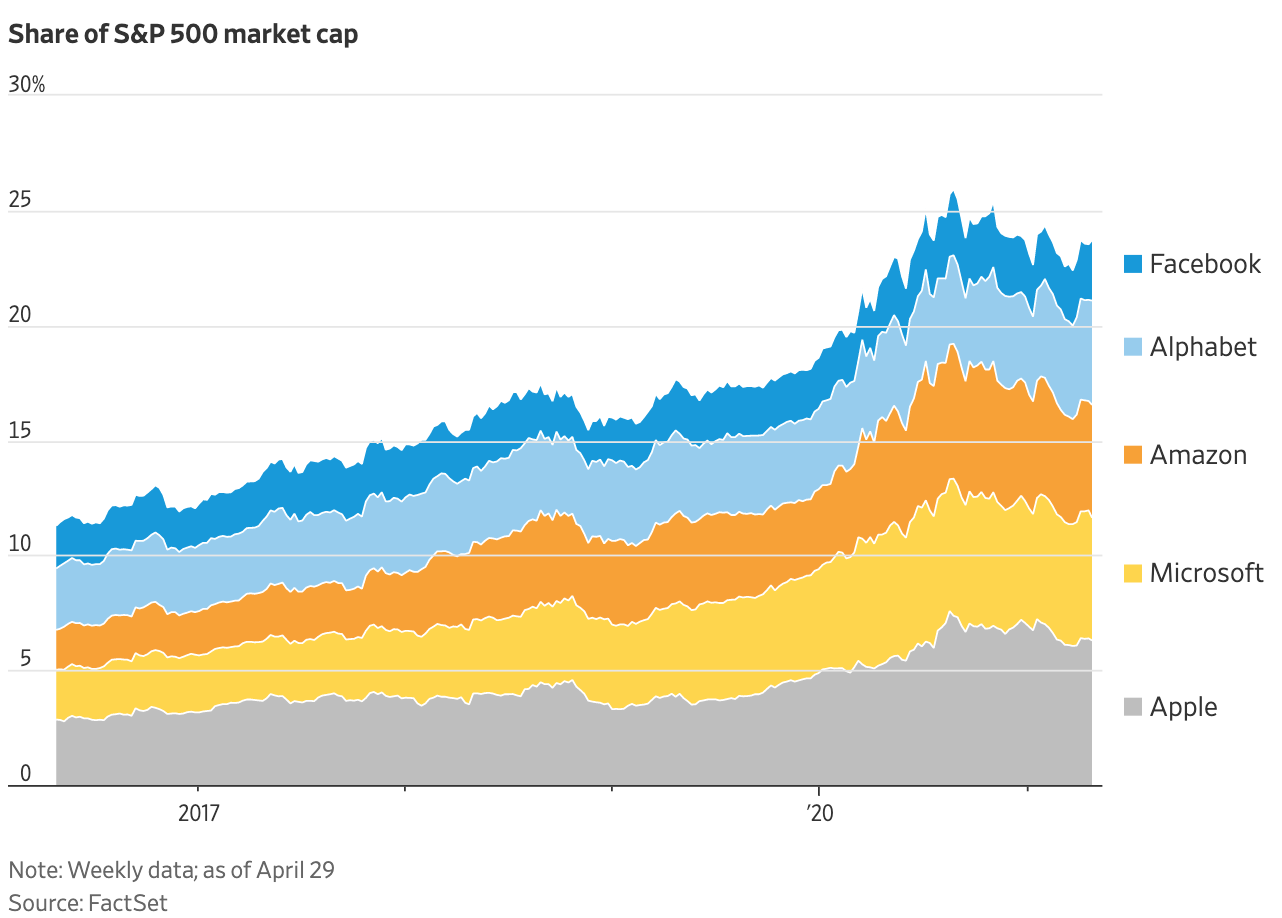

Not only that, but the 5 giants now constitute an ever growing percentage of the broader stock market, making up nearly 25% of the S&P 500 market cap.

Buffett mentioned the primary driver of tech’s performance over the last 1.5 years to be interest rates and aggressive Fed policy:

[US Treasury] had applications on the four week Treasury Bills 400 and some billion. They accepted bids for 43 billion worth. And it says average average price 100.000000. 6 Zeros. And essentially people were giving 40 some billion dollars to the treasury and they offered to give 130 billion or something whatever the amount tendered. Yeah at the Treasury received the money at zero.

At $2 trillion committed or disbursed, purchases of long term Treasuries was the largest line item of the $12 trillion Congress approved to manage covid fallout. The explicit goal of these purchases was to increase the money supply. When the Federal Reserve buys Treasuries, they push down yields (interest rates) and introduce newly created dollars into the system. This is what people mean when they say the government is “printing money”.

Buffett went on to talk about the relationship between interest rates and equity valuations:

It gets back to something fundamental investments. Interest rates are basically to the value of assets, what gravity is to matter

…

If I could reduce gravity, it's pull by about 80%. I mean, I'd be in the Tokyo Olympics, jumping... So you've had this incredible change in the evaluation of everything that produces money because the risk free rate produces really short enough right now, nothing very interesting.

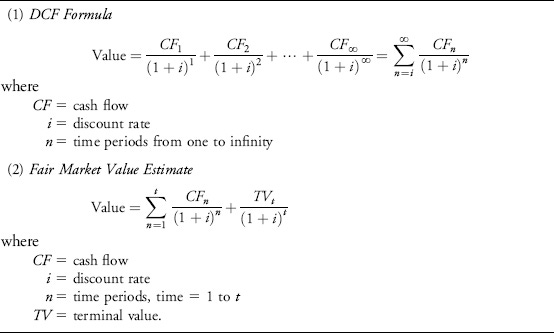

Traditional investment analysis consists of predicting future expected cashflows and discounting by an interest rate that’s partially based on the government risk free rate.

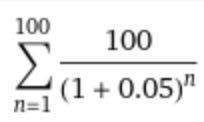

Suppose you have a machine that just prints $100 every year and has an expect life of 100 years. How much would you pay for this machine? Assuming you can earn 5% elsewhere, the most you’d be willing to pay is ~$1,984.

Suppose we change that number from 5% to 4%. Now the most you’d be willing to pay is $2,450, an increase of ~23%.

Actual discounted cashflow valuations include a net income growth rate which eventually flattens off, but the relationship is the same: low interest rates positively affect valuations:

Buffett mentioned the effect low rates had on his balance sheet and noted the scale of the change:

And here we are in this world where we had zero interest rates last year… Let's say we had a $100 billion dollars in in Treasury bills… We were getting about a billion and a half from that year at present rates. If it's two basis points, we get 20 million, imagine your wages going from $15 an hour to 20 cents an hour.

Note that the actual interest rate you’d use for a risky investment would be risk free rate plus some margin. From our example above, we increased the valuation of our money printer by 23% with just a 1% move in rates.

Part of the point of low interest rates is to juice equity valuations. It’s spun by officials as “promoting investment” or filling in the gap between private and public spending due to unforeseen circumstances. And to an extent that true. But in practice the main beneficiary is large corporations and investors.

But changes in interest rates don’t affect all stocks equally as Buffett goes on to explain:

But that is why the Googles and the Apples when we don't know, but we don't know Microsoft, but they are incredible companies in terms of what they earn on capital, They don't require a lot of capital and they gush out more money. And if you're trying to find bombs that gush out more money from the federal government, we've got 100 billion negotiating out like, you know, $30 or $40 million so that puts the pressure on, which is exactly, of course, what the monetary authorities want done.

When money managers are earning practically nothing on their cash, they look to alternatives. And the large tech companies are very consistent performers with great cashflow. Given the low interest rates, tech companies are a great value:

But, but if present rates, were destined to be appropriate, if the 10 years should really be at the price… they have the ability to deliver cash at a rate that's if you discount it back. And you're discounting that present interest rates stocks are very, very cheap.

However depending on where you see long term rates, they may not be a good value in the long run and may be most negatively affected by an unexpected rise in rates.

Helicopter Money

Buffett goes on to point out the unprecedented expansion of both fiscal and monetary policy. He points out that nearly 85% of Americans received a $1,400 check:

We've never really seen what shoveling money in on the basis that we're doing it on a fiscal basis while following a monetary policy of something close to zero interest rates. And it is enormously pleasant…. 85% of the people were going to get a $1,400 check. And a couple of years ago we were saying 40% of the people couldn't come up with $400 of cash. So we've got 85%

I didn’t know the percentage of households receiving a check was so high but it checks out. At this point, it’s more of a basic income experiment than a supplement to those affected by the lockdowns.

But what about the effects?

And so far we've had no unpleasant consequences from it. I mean, people feel better. The people who get the money feel better and and people are lending money don't feel very good, but it causes stocks to go up. It causes business to flourish. It causes an electorate to be happy.

Well sure. Everyone likes money. It’s similar to helicopter money, an idea first proposed by Milton Friedman in 1969 in the paper The Optimum Quantity of Money:

Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us suppose further that everyone is convinced that this is a unique event which will never be repeated.

— Milton Friedman (The Optimum Quantity of Money)

This was more of a thought experiment by Friedman as a way to increase increase broader economic activity and push inflation back up to the central bank’s target. But in recent years, Fed officials took it as a challenge more than anything else.

Buffett is not one to make predictions, especially about the future. But he does note that decisions have consequences, and until we see negative consequences, we can expect a continuation of these policies:

And, we'll see if it causes anything else and if it doesn't cause anything else you can count on and continuing in a very big way. But there are consequences, everything at economics

Final Thoughts

I think Buffett is correct that the main beneficiaries of an easy money policy are the largest corporations, namely the large tech companies. But it’s also true that the large tech companies are frothy in part due to their unwavering growth over the last decade.

Take a look at the revenue of the 5 giants (log scale):

Besides Microsoft, all the other companies have seen very high sustained revenue growth. Facebook went from revenue of $770 million in 2010 to $86 billion in 2020. In that same period, Google went from $23 billion revenue to $182 billion in 2020. And they’re not slowing down, as is expected in large mature companies.

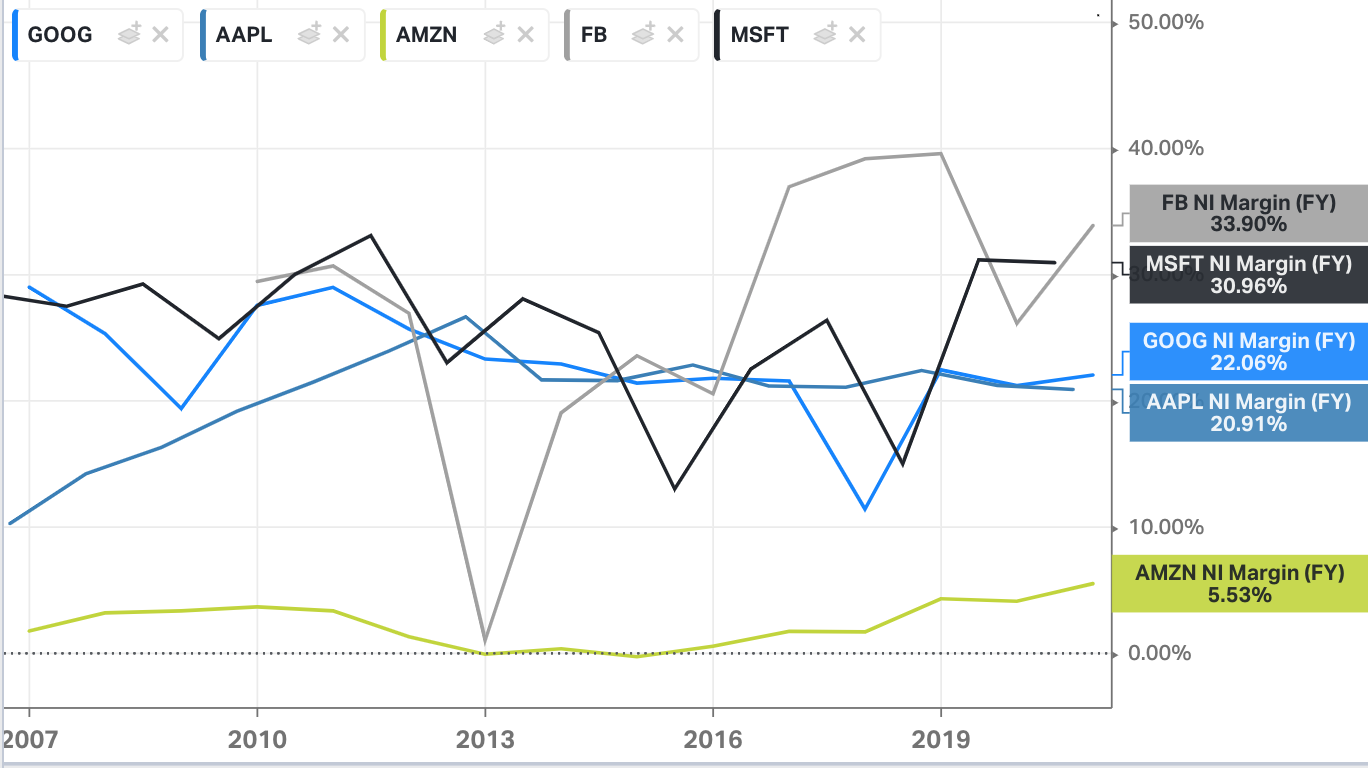

Their profit margins have also stayed fairly consistent despite the explosive growth:

These growth rates are expected to continue in in the near future, but double digit growth is unsustainable long term because, you know, the finite number of atoms in the observable universe?

I admit that the tech companies may also benefit from a post-covid world as much of the Western world continues to experiment with a work from home model. Although, apart from the effect on Amazon, I think that’s oversold. I don’t see why people working from home will result in more Google ad revenue.

The tech giants could improve margins by hiring workers outside of San Fransisco and New York, but (apart from Amazon), they seem more focused on growing top-line revenue as opposed to expenses. Besides, how would it look to regulators if Facebook had an 80% margin?

But the primary reason the tech stocks have performed well is a low interest rate environment. The question is why do we continue to promote these policies under the guise of helping individuals and small businesses cope with lockdowns? And what’s going to happens once all this money in the system stops affecting just asset prices and starts showing itself in consumer prices?