This is part 4 of my series on the strange post covid market rally due to $12 trillion in new spending.

Part 1 was focused on purchases of mortgage backed securities by the Federal Reserve.

Part 2 was focused on increases in asset prices across all sectors and asset classes.

Part 3 was an alternative explanation of what could be going on.

Every chart, unless otherwise linked was made using koyfin (unaffiliated - incredible free Bloomberg-like terminal).

If you’re interested in this series, subscribe below to receive updates. It’s free.

We’ve obviously seen a lot of inflation in the form of asset prices. But we haven’t yet seen consumer price inflation. Going forward, when I use the word inflation I’m referring to consumer price inflation.

The typical effect with a massive expanse in monetary base is inflation. Milton Friedman said:

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output

Inflation doesn’t occur every time there is a large expansion in the monetary base, but nearly every case of inflation happens in conjunction with a large expansion of the monetary base. But we haven’t seen much inflation yet, currently projected at under 2%.

Historical relationship between money supply and inflation

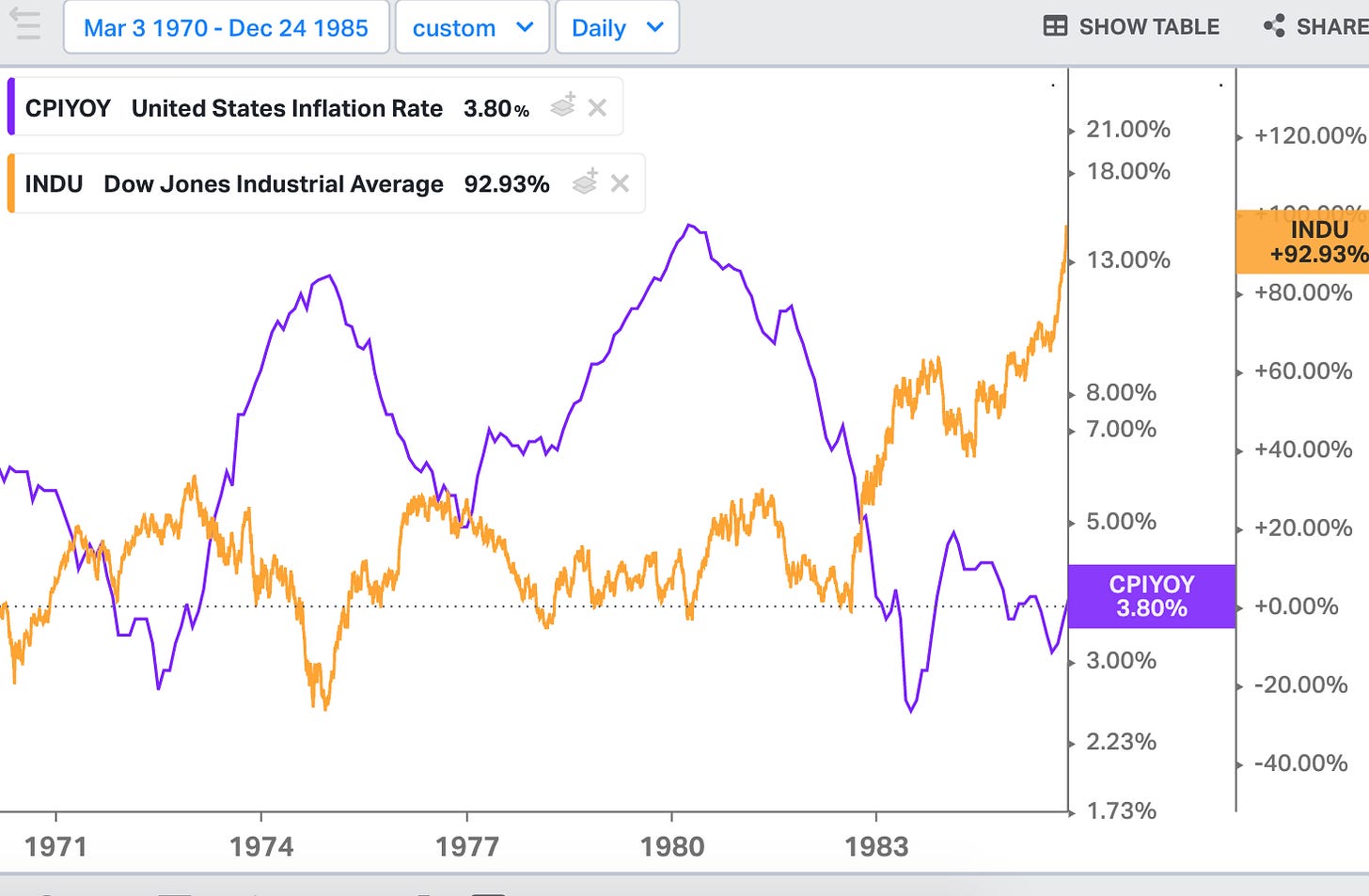

Since the 1970s, the US has seen very high inflation (> 10%) during two periods: mid 1970s and late 1970s to early 1980s, with a peak of 14.8% in March 1980.

At a rate of 14.8%, prices would double in 5 years. Which means your net worth would be cut in half every 5 years if your money was just sitting around (sorry grandma).

You saw an increase of money supply a few year before inflation caught up. M2SL is nominal M2 money supply (not inflation adjusted).

Let’s expand this chart to include today. See if you notice anything weird.

Since 1983, the last time we saw the money supply grow by more than 10% YoY was a few months post 9/11 and a few months in 2012. Now we’re at 2.5 times that level.

Stock market performance during inflation

Normally during times of rising inflation, you don’t see the stock market go up. Often you’d see the market crater as it did in the mid 1970s. Only after we broke inflation in the 1980s did we see stock prices rise. We basically had a lost decade in 1970s where the stock market didn’t grow and everything became more expensive. 1971 was weird.

The way we broke inflation was through raising interest rates, which causes pain. Mortgage rates shot up to nearly 20%.

To put this in perspective, a $100k mortgage at 20% interest would cost. you $1,671 vs $421 if the rate was 3%. Low interest rates are in no small part the reason home values have exploded.

Consumer Price Index

If you look at the constituents of CPI, over 50% is made up of housing, education and medical care.

I don’t see how inflation could be consistently below 2% for the last 20 years when cost of housing, medical care and education has gone through the roof. My guess is that it has been kept down by technological advancements in food production and other consumer goods.

You can get a detailed breakdown of the CPI constituents. It’s hard to make sense of everything because there are a lot of moving parts and discretion involved. But needless to say, officials have an incentive to keep the official reported inflation at bay, especially considering programs like social security are tied to this number.

Arguments for why inflation won’t occur

We haven’t seen inflation yet. Much of what is true today was true over the last 20 years. The common consensus among fed officials is that we “solved” inflation. The officials have unprecedented metrics and power at their disposal. They know what they’re doing.

The money supply increase was needed to re-inflate asset prices. Maybe they overshot the levels and re-inflated a little too much and this is the new Nash equilibrium. Asset price growth will decline and return to a more reasonable level. We’ll increase taxes a bit, transfer some of that new money from capital holders to the rest of Americans.

If we see any inflation, we’ll just raise rates to sop up some of that excess supply. We’ll bite the bullet and bear the political costs associated with higher rates.

Arguments for why inflation will occur

You can’t just increase the amount of money in an economy by 23% in a given year without seeing prices go up. That’s like slicing a pizza into 10 slices as opposed to 8 because you’re really hungry. You have to do a lot of rationalization to show that printing money won’t just push up prices. Both logic and history tells us that high inflation is the most likely outcome.

We’ve already seen this in asset prices across the board and commodities. It’s only a matter of time until it flows through to the CPI constituents.

How you can hedge

Not investment advice. Entertainment purposes only.

Treasury Inflation Protected Bonds

The simplest and most direct way is to buy an ETF or mutual fund that’s designed to protect against inflation. For instance, iShares TIPS Bond ETF (TIP) holds inflation protected government bonds. So if inflation goes up, these bonds pay a higher rate, so they should be relatively unaffected by inflation.

But if you think the officials are playing games with inflation, this doesn’t help you much. Reporting inflation is so complicated that they can turn a few knobs to affect the official reported rate. Literally trillions of dollars in increased government expenses are tied to this number. So you could see your living expenses going up while official inflation is low.

Gold

Traditionally gold has done well during time of inflation. You can invest in an ETF tied to gold. It has appreciated considerably during the early 1970s.

However, it hasn’t really kept up its value in real terms in 2000s:

The problem with gold is that it’s highly influenced by the central banks around the globe. Globally, central banks and supranational organizations – such as the International Monetary Fund and the Bank of International Settlements – currently hold almost 34,000 tonnes of gold as reserve assets (17% of total aboveground stocks).

So again, if you think the officials are playing games and want to discourage hoarding gold, they can manipulate the price. Executive Order 6102 signed in 1933 did exactly that, forbidding the “hoarding” of gold coin, gold bullion, and gold certificates within the continental United States. That was when the dollar was tied to gold though, so that was an attempt to pump up the money supply without running out of gold used to back up the dollar. Any government action against gold today would be a lot more nefarious as it would have nothing to do with preventing a run on the USD, but eliminating options for savers. But given what we’ve seen over the last decade, it wouldn’t shock me.

Real assets

Real assets like real-estate and commodities can hedge against inflation. We’ve already seen both valuations increase, which isn’t saying much since literally all sectors are up considerably. But real-estate is heavily driven by mortgage rates. So if the Federal Reserve raises rates, you would likely see a drop in home prices. Productive assets such as farm land may be a better hedge.

Short market

You could bet on the stock market dropping, but that’s not a sure thing either. So far we’ve seen asset price inflation, which may continue even if consumer prices start increasing. Or they could tank. I don’t know which one is more likely.

Bitcoin

Finally you can invest in Bitcoin or other crypto assets. The price of Bitcoin has gone up a lot, in no small part due to the growth in money supply. I would post an image of the price but it would just look like 📈. The risk there is similar to gold. If officials want to stop flight from the dollar to assets like gold and Bitcoin, they can try to restrict them. However, I don’t think central banks have built up a significantly large position of crypto assets to manipulate the prices directly.

They can’t ban Bitcoin because it’s not a thing you can ban, it’s a protocol. They can try to ban mining, but most of the mining isn’t done in America. They can try to regulate or ban exchanges, which may be effective. But you see a lot of institutions getting involved, which likely means there would be a lobbying arm against measures that would crash valuations.

Finally, the US is not very good at this sort of thing, even when it has an incentive to do so. Consider AirBnB which is basically built on illegal rentals. Hotels, landlords, neighbors and luddites hate them and have lobbied for all sorts of measures. The only people who like them are tourists and small landlords, not the most powerful political force in America. But we still haven’t seen any effective legislation or regulation meant to curtail them. Anyone can log on to AirBnB now, pick a large city, and find dozens of illegal rentals. If anything the officials look to extract some money from the organization, with AirBnB effectively paying off local governments. Similarly, destroying hundreds of billions of dollars of Bitcoin is unlikely as something like taxing gains on appreciation of Bitcoins held.

Here’s my totally not investment advice summary of the options to hedge inflation: