This is part 5 of my series on the strange post covid market rally due to $12 trillion in new spending.

Part 1 was focused on purchases of mortgage backed securities by the Federal Reserve.

Part 2 was focused on increases in asset prices across all sectors and asset classes.

Part 3 was an alternative explanation of what could be going on.

Part 4 was about the likelihood of future inflation and hedging strategies

Every chart, unless otherwise linked was made using koyfin (unaffiliated - incredible free Bloomberg-like terminal).

If you’re interested in this series, subscribe below to receive updates. It’s free.

This article caught my eye:

Turkey bans crypto payments citing risks, hits Bitcoin price

Turkey's central bank banned the use of cryptocurrencies and crypto assets to purchase goods and services, citing possible "irreparable" damage and significant transaction risks in a move that cooled global bitcoin prices.

But the real reason was mentioned a few paragraphs below:

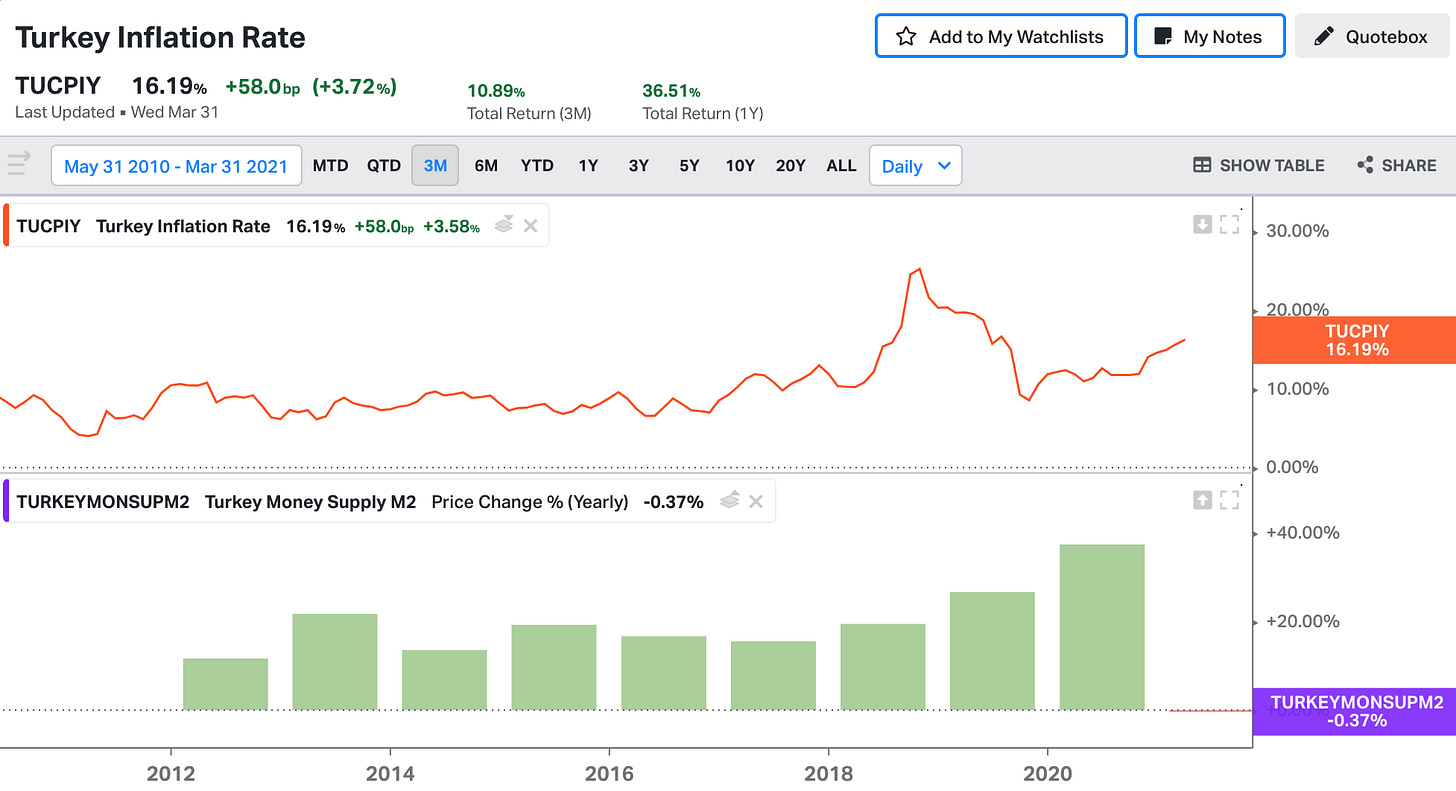

Turkish annual inflation is at a six-month high of 16.19%, well above a 5% target, and unemployment remains high, at 13.4%.

People are losing faith in their currency as inflation continues. But this time, they have an option to invest elsewhere. And central banks don’t like competition.

But is it really about the money supply?

Yes.

12-31-2020 saw an annual growth in M2 money supply 37.33%, and it hasn’t dropped below 13.5% since 2013. Inflation is almost always associated with a significant increase in the monetary base. It doesn’t happen immediately every time, but where you see inflation, you’ll see loose money.

For comparison, this is how US inflation (orange) looks compared to growth in money supply (green).

USD as the Reserve Currency of the World

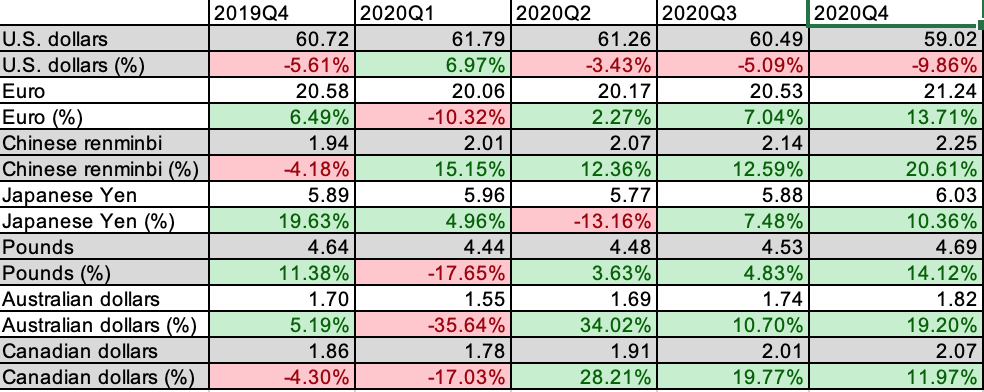

US is fortunate to have its currency as the reserve currency of the world, which supports USD. But that may not last forever as China is actively ditching dollars.

And why wouldn’t they? US Dollar share of global reserve dropped an annualized -9.86% in 2020-Q4 while virtually all other currencies gained ground with Chinese Renminbi gaining the most:

Speaking of Chinese Renminbi, how much money did China print to deal with the fallout from covid?

They haven’t made a meaningful change in their money supply, and have actually decreased their money printing over the years. And their GDP growth rate was a record 18.3% YoY in 2021-Q1. So they seem to be doing quite well. Yes, this is Chinese data, you can’t trust anything they say, caveat emptor.

But surely Europe also printed a lot of money for covid. Why is their share of global reserves growing?

In a sense, they did increase their money supply. They grew their M2 money supply by 11% in 2020. But when you compare that to what the US did, you’ll see that it pales in comparison:

US grew their money supply more than twice as much as Europe in response to covid.

Common sense would tell us that you can’t create long sustainable value by just printing money. What you’re doing is hoping you can use sticky prices to your advantage. Print a little money and hope no one notices. People don’t start paying attention until they do. And it seems like the central banks around the world are starting to pay attention. Especially considering the magnitude of what the US did with its money supply compared to that of every other country.

What does increasing the money supply actually accomplish? It transfers wealth, from savers to capital holders. The poor will be hurt with higher prices and lower purchasing power. Savers will similarly be hurt as the value of their savings diminishes. But capital owners may benefit from inflated asset levels as people look to store their wealth in a non-depreciating asset. But that may not last either as high inflation is often accompanied by a market crash and overall turmoil.

But at least the US government can still ban Bitcoin. That should help.