This is part 7 of my series on the strange post covid market rally due to $12 trillion in new spending.

Part 1 was focused on purchases of mortgage backed securities by the Federal Reserve.

Part 2 was focused on increases in asset prices across all sectors and asset classes.

Part 3 was a satirical alternative explanation of what could be going on.

Part 4 was about the likelihood of future inflation and hedging strategies

Part 5 discussed the role USD has as a reserve currency

Part 6 discussed Warren Buffets assertion that low rates help tech stocks

Every chart, unless otherwise linked was made using koyfin (unaffiliated - incredible free Bloomberg-like terminal).

If you’re interested in this series, subscribe below to receive updates. It’s free.

In my prior posts I discussed that most of the covid spending didn’t go to direct relief. $6 trillion of the $12 trillion allocated went to “Federal Reserve Actions” such as buying government debt, mortgage securities and repo measures.

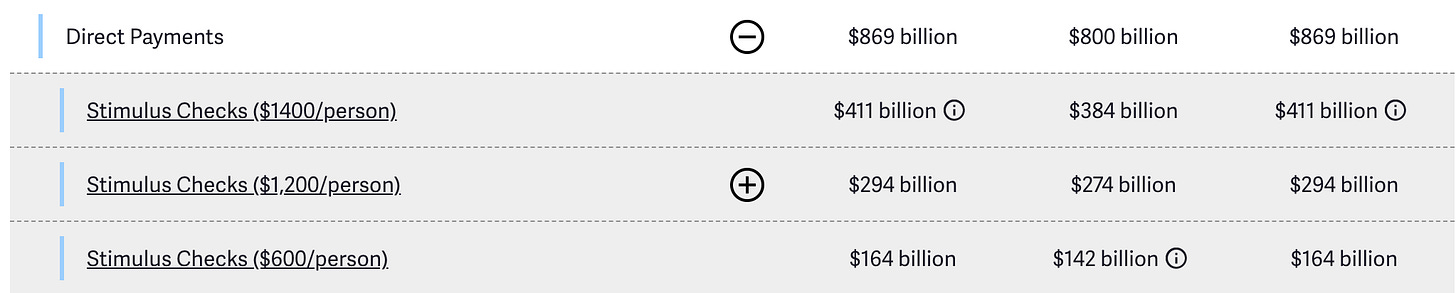

But some of the money did go to individuals. $800 billion went to direct payments. Around 83% of tax payers (125 million people) received a stimulus check.

I’m not sure why the math doesn’t work but it’s good enough for government work.

Another $750 billion was allocated for additional unemployment benefits. And $790 billion was allocated for Paycheck Protection Program (PPP), which gave loans to employers for spending on payroll.

I’m sure some Americans used this money to put bread on the table. But the scope of those receiving checks was so broad (83%) that it mostly went into savings. The savings rate shot up in response:

United States historically has a low savings rate, so much like the rest of the last year and a half, this response was unprecedented.

Savings aren’t necessarily a bad thing, but they explain where much of the direct payments went and why it coincided with a historic rise in financial asset prices. It gave that little pop to the market when it needed it most.

It’s hard to attribute most or any of the rise to the stock market to personal savings, since it coincided with many other legislative and monetary actions. But it’s not unreasonable to think that a large percentage of people receiving a one time stimulus just invested it. I know that’s what I would do.

Savings rate impact on the economy

The savings rate is also country specific. China has a savings rate that was has been above 30% for much of the last few decades.

(I’m not sure why United States isn’t updated to 2020 in the chart above, but St. Louis Fed confirms the rapid spike mentioned above)

According to the Federal Reserve, China’s high personal savings rate is primarily due to the economic reforms China began in 1978. The reforms removed many government jobs. They also shifted the burden of retirement income to households. Finally, the financial market and banking system is still underdeveloped, although I imagine that’s improving rapidly.

The paper then goes on to mention the high savings rate fueling Chinese economic growth:

Economic theory predicts that the development of financial market and social insurance programs may dramatically reduce China’s saving rate (at both household and national levels). Such a decline in the saving rate may slow China’s speed of growth because economic growth is driven partially by domestic investment, which in turn is financed mostly by domestic saving.

Is the increase in US savings fueling economic growth? It’s certainly fueling asset prices, everything from Google to GameStop to crypto. And maybe US industries will use this frothy environment to invest in long term growth. But more likely they’ll use the cheap money to fund stock buybacks and other financial maneuvers.

In the US there is a consensus that entitlement programs are good; at least the big ones (social security and medicare). And everyone loves jobs, be-it government sponsored or private. So entitlement programs will continue to grow and the savings rate will come down.

Perhaps the influx of savings just helped people out of a hole. No longer will only 41% of adults be able to withstand an unexpected $1,000 expense. Now that we’re all topped off, going forward we should be good.

Or perhaps money will eventually flood the market, push up consumer prices, lead to price controls, rationing, civil unrest and eventually more restrictive economic policies. And that 2020 windfall won’t seem like such a great deal after-all.