This is part 3 about where the $12 trillion the US government allocated for covid relief went.

Part 1 was focused on purchases of mortgage backed securities by the Federal Reserve.

Part 2 was focused on increases in asset prices across all sectors and asset classes.

If you’re interested in this series, subscribe below to receive updates. It’s free.

In the first two parts of this series, I argued that the dramatic increase in spending and money supply by governments around the world led to asset price inflation. It’s true that asset prices are up to levels even higher than pre-Covid. But maybe there’s an alternative narrative.

A pleasant surprise

In early 2020 when Covid-19 was first emerging as a global pandemic, everyone thought the effects would require a shutdown of many years (3 years to flatten the curve). That explains the dramatic drop in March of 2020. Only through the effective leadership of federal and state governments were we able to reduce that to just over a year and counting. With any luck, we should be able to see our family this fourth of July.

Institutions

Government officials and institutions ensured this pandemic was contained. We made sure that testing was cheap and ubiquitous. The FDA approved at home Covid tests as early as last week. Track and trace was executed flawlessly and we implemented strict checks at airports and state borders with mandatory quarantine. Governors from all states were objective and transparent in reporting Covid deaths and didn’t play politics.

Financial support and public dialogue

We ensured the millions of workers that were laid off received a generous $1,600 check to make up for their inability to work over the last year. There was reasonable discourse about mask policies and how the virus spreads. The distancing policies were reasoned and effective and prevented risky activities like walking in open-air parks.

Transfer of power

We had a mostly peaceful transfer of power. Nothing instills confidence in markets as a functioning political environment. We can continue to hold up American democracy as a model for the rest of the world.

Business competitiveness

The rally was also driven by the laser focus of American businesses. Over the last decade, there has been a continual focus on competition and delivering value to customers. Companies focused on hiring the best and brightest and stayed away from political distractions.

Just look at how far we’ve come. When the first iPhone came out, I would have never guessed how far we’d come along in only 14 years. I mean, what happened to the bezel?

Corporate outlook looks extremely positive as well with an anticipated corporate tax hike. Treasury Secretary Janet Yellen even proposed a minimum global corporate tax. Corporate tax hikes will allow the government to invest in “the economy” which will result in higher future earnings across the board. Naturally, we should see stock prices jump in response.

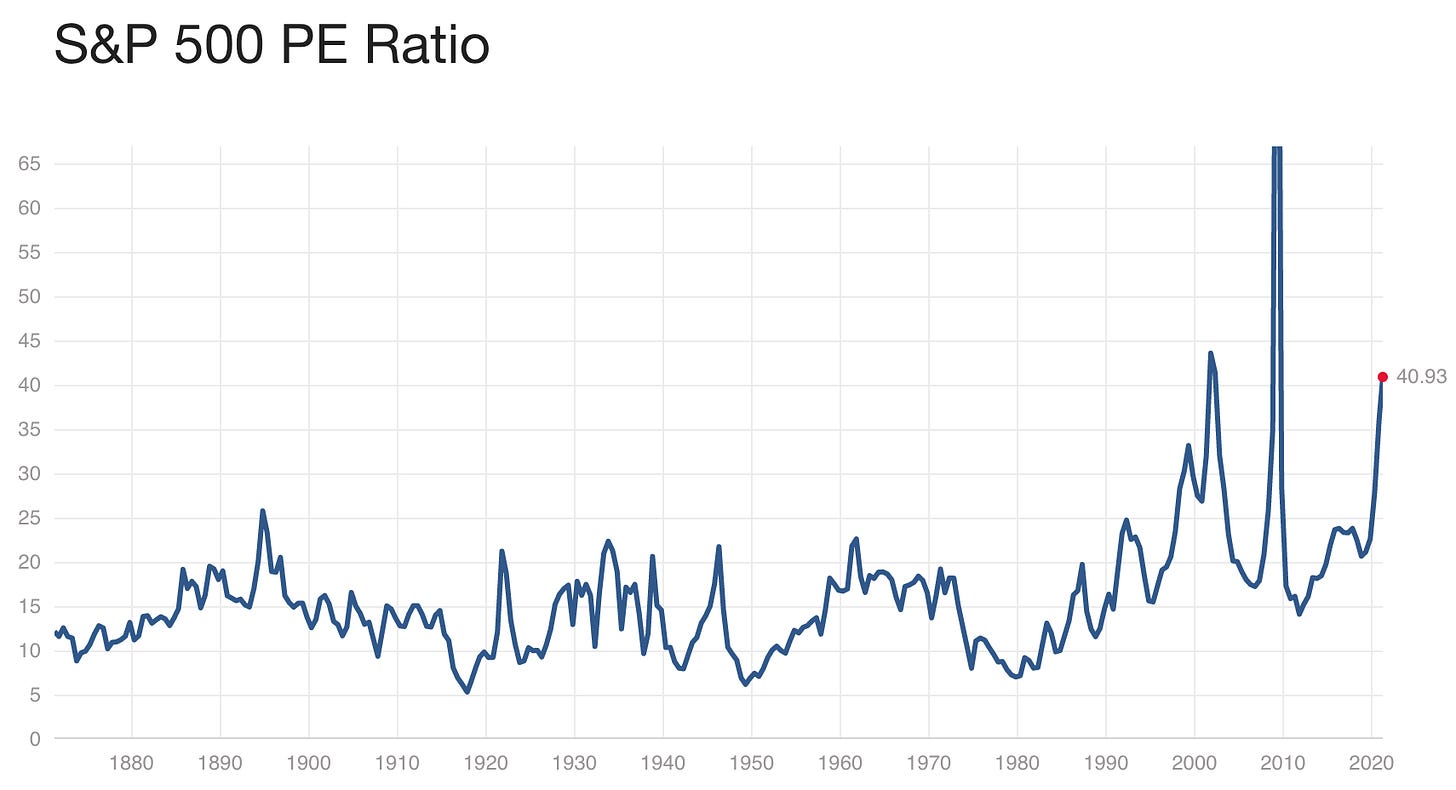

This cutting edge innovation and positive tax/regulatory outlook shows up in the numbers via the price earnings ratio (a measure of how expensive a stock is relative to its earnings). The price earnings ratio is currently at ~41. The last time it was this high was 2007, where it ended up peaking to a rate over 60 (ignore 2008 financial crisis). And in ~2001 it peaked at 44 (ignore 2001 tech bubble). Before that it was never that high, so we must be doing something right.

Wall Street took note of the monumental effort and efficiency of our institutions. Not only did markets quickly recover from the initial drop due to Covid, but the renewed faith in institutions resulted in asset valuations 30% higher than pre-Covid levels.

And why shouldn’t asset valuations be at all time highs? It certainly has nothing to do with the Federal reserve creating trillions of dollars and injecting it into the economy. I’m pretty sure they know what they’re doing.