US federal tax receipts have been remarkably consistent

No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP

Every election year you hear the same arguments about tax rates. It’s one of the oldest arguments in politics so everything that can be said about it, in favor or against, likely has been said. But allow me to indulge briefly.

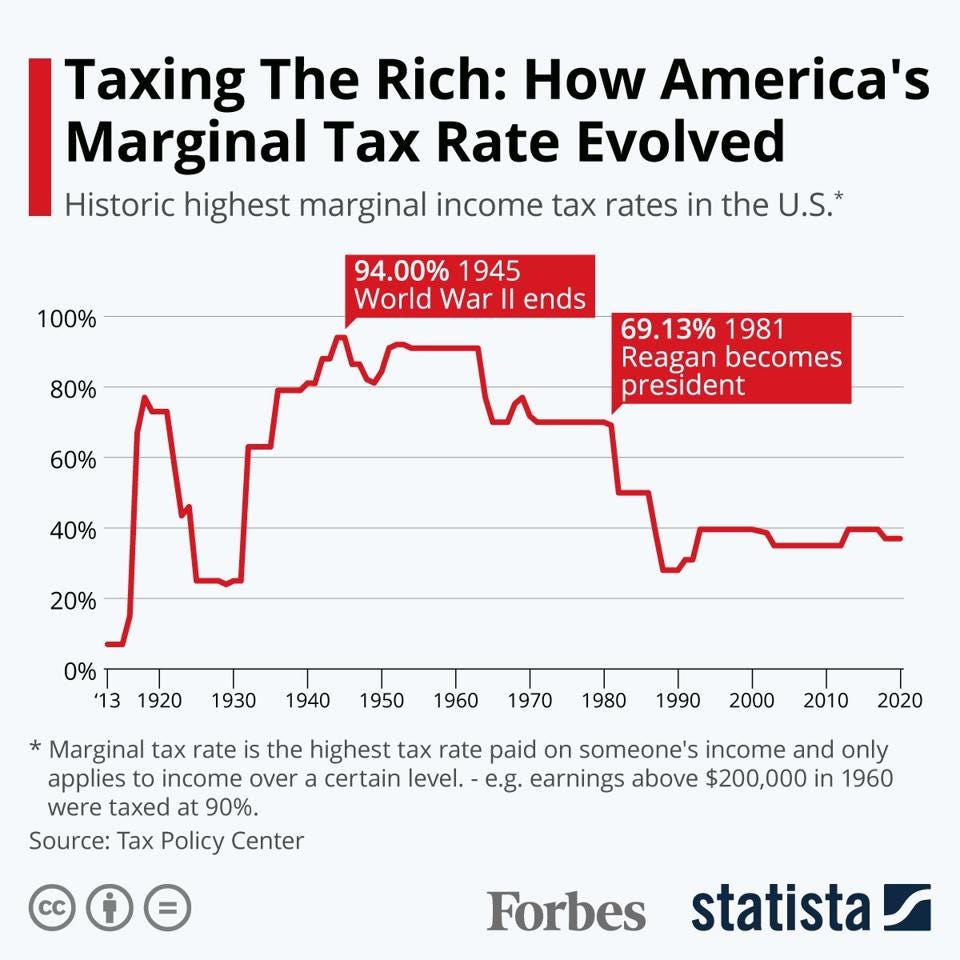

A common refrain form the pro-tax crowd is “We had marginal tax rates over 90% and we were just fine”. And its true, top marginal tax rates were considerably higher prior to 1980.

But top marginal tax rates are less important than tax receipts. And in terms of federal tax receipts as a percentage of GDP, they don’t change much.

This is called Hauser’s Law:

No matter what the tax rates have been, in postwar America tax revenues have remained at about 19.5% of GDP.

Note there are slight differences between how William Hauser defined tax receipts and the St. Louis Fed chart, but both are consistent over time despite wildly different tax rates.

Top marginal tax rates are just a distraction. The top rate doesn’t matter if no one is paying it. And back when it was 90%, very few people were paying it. Today, many more people fall into the top tax bracket.

It’s also not a closed system. If every additional dollar was taxed at 90%, you’d likely forgo a higher salary for other benefits. My father had a company car and apartment. This sounds like a nice perk, but these policies were designed to get around a high marginal or corporate tax rate. That’s why places like Meta offer free meals, because they know the marginal dollar is worth $0.6 to their employees due to high taxes. Not to mention the corporate tax discount they get for providing the perk.

This is my main objection to higher marginal tax rates. Sure, people will get around it more or less, but its incredibly inefficient and wasteful. And that inefficiency is difficult to measure and has other negative effects on productivity.

But this is unlikely to convince anyone that we shouldn’t just blindly raise top marginal tax rates. Unfortunately many of those strongly in favor of raising taxes are less concerned about receipts than some form of signaling or punishment on the wealthy.

But the good news is, it probably won’t matter much anyway.

Lots of people care far more about punishing the productive than about helping the poor.

"Tax the rich, feed the poor, till there are no rich no more". -Ten Years After, "I'd Love to Change the World", 1971.

https://www.youtube.com/watch?v=cY_1ZFNgY2g