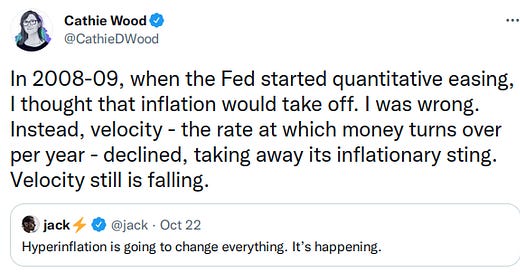

I see the “velocity of money” brought up when discussing inflation. It is usually used to attack the idea that inflation is happening or a threat.

People often define velocity of money is “the rate at which money turns over per year”. It sounds like a sophisticated measure that somehow tracks how much each dollar changes hands. But it’s a lot simpler than that:

Velocity of Money = GDP ÷ Money Supply

That’s all it is. So when you’re talking about money turning over relative to money supply, why not just use GDP? We can make the tweet above a lot simpler:

In 2008-09 when the Fed started quantitative easing, I thought that inflation would take off. I was wrong. Instead, GDP growth declined, taking away its inflationary sting. GDP growth is still falling.

This has a different tone to it now. When people talk about “velocity” in relation to money supply they’re really talking about GDP. That’s the only variable left.

But doesn’t velocity have something to do with inflation?

From what we just discussed, we can re-frame the question as “doesn’t GDP have something to do with inflation”. And the answer is no, not really. Inflation is almost always a monetary phenomenon. It comes from printing money, so each dollar in circulation is worth less.

The reason people prefer to use “velocity” instead of GDP, is that it’s much more obvious that the relationship between inflation and GDP is pretty much non-existent. The few times we had run high inflation in the US (1970s) we actually saw a slight drop in GDP growth.

So if you look at a graph of velocity and inflation, you’ll see a similar relationship.

Still don’t believe me? Just read what the St. Louis Fed said in describing the relationship between M2 velocity and inflation:

Eyeballing the graph, we see no clear relationship between these variables… Not much of a relationship can be found here. If anything, there is a slight upward slope, indicating that higher M2 velocity is associated with higher inflation, although this would not be statistically significant.

Stop making this mistake

It’s exhausting to read the same misinformed talking point by people trying to dismiss inflation fears. They’re obviously repeating what they had heard somewhere or never took the time to look up the formula and look at a few graphs.

It’s not just Cathie Wood. Krugman made the same arguments, but given that he ought to know better, I take his comments as being made in bad faith.

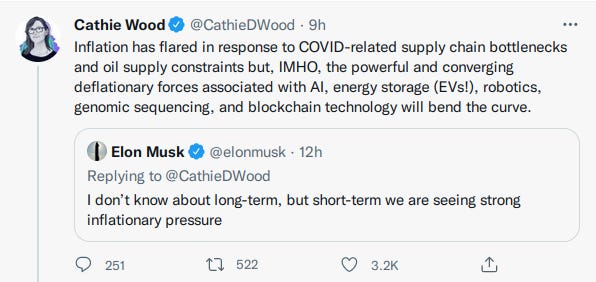

I would be remiss not to mention a few other gems from Cathie Wood’s tweet chain:

Let them eat neural networks!

I know its become a meme to say that people on the coasts live in a bubble, but come on. Energy and food prices are going up, but hey, at least the cost to train our models is going down!

The thing with AI is that it’s always poised to change everything in 5 to 10 years. Most of the industries that use AI are using it to sell AI hype. For the rest, the training costs are insignificant to the actual value generated. Even the most ambitious AI project in recent history, GPT-3, took between $4.6 - $12 million to train. Sure that’s a lot of money, but that’s nothing compared to pretty much anything else industry does.

But hey, it’s not just AI training costs that’s going to disinflate:

I can’t wait to use my 23 and Me discount code, not to mention how much I’ll save running an ethereum node on my cheaper custom asic hardware. That should hold me over for the near future.